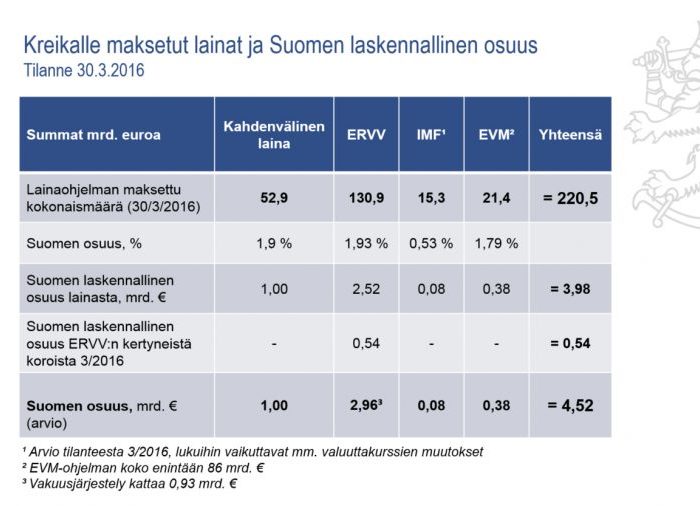

Finland has already made loans and guarantees, directly and indirectly, of over €4,5 billion to Greece according to the Ministry of Finance. During this time, we have not received any repayments and has only received some €70 million in interest payments this past 6 years.

Finland has to pay some 3% on average for every borrowed Euro. That means our annual interest rate costs are €138 million for these loans. That makes a loss of over €120 million every year. Finland has no guarantee that Greece will repay their loans over the next 50 years.

The true interest rate loss is much greater because when the first loans were made, Greece was paying double digit interest rates to the banks.

These same banks have received over €200 billion in loan repayments, thanks to Finland’s stupid, repeat, stupid generosity.

In today’s national newspaper, Aamulehti, Nordea Bank’s chief economist has estimated that Finland interest rate loss was a “small loss”. He mentiones €5 million for each year based on a €1 billion loan. How did he forget the other €3,5 billion?

Finland’s former prime minister, Jyrki Katainen, who is now a Deputy Commissioner at the European Commission has praised these loans as “great deals”. It is no wonder why confidence in our EU leaders and in the banks has fallen to a new low with ordinary folk.